2011-07-10 11:38:29

Money Is A Bitch That Never Sleeps

************這篇影評可能有雷************

終於整理出來了,華爾街裡面一段非常有意思的演講,中文版加英文原版。其實這部電影本身並無太大出彩的地方,但是道格拉斯的這段話讓我感觸很深。

所謂的投機,就是買低賣高,賺取中間的差價,沒有產生任何的附加價值,就像是賭博,漲了你就賺,跌了你就賠,風險非常的大。我們經常聽到的高深的金融名詞,實際不過是把一塊錢本身用兩塊錢賣出去,然後再變成三塊錢、五塊錢、十塊錢,然後無止境的增長下去,但實際上,只有一塊而已。阿基米德在公元前就預料到了:「給我一個槓桿,我可以翹起地球。」金融家們用這個槓桿把全球經濟都翹起來,我不得不感慨阿基米德原來是章魚哥。

既然這樣,就有人會問:「難道沒有知道這樣做的後果是什麼嗎?」其實,大家都明白,大家都在賭,賭這個定時炸彈最後留在誰手裡,誰倒霉,等到東窗事發的時候,銀行家就向政府哭窮,然後拿到錢了繼續賭。

我寫這篇日誌不是為了抱怨投機有多麼不好,多麼危險,而是想要敲響一個警鐘,投資是件好事,但是在現在經濟過熱,泡沫橫生的時候,怎樣投資,是一個值得斟酌的問題。人類的天性,隨大流,當哪個行業賺錢,就往哪裡走,這也印證了物極必反的道理,當市場價位被炒得高於了其本身價值,就會產生泡沫經濟。如今中國的房地產行業就像一個鼓脹的氣球,到底是繼續吹,還是爆炸,這個很難說清楚。也許可以借用電影裡面的話,下一個泡沫就是綠色能源,如果你也認同這個想法的話,不妨嘗試一下,說不定,你就可以搶佔到先機。

因為不能分享youtube的視訊,所以,感興趣的話可以去看這部電影,這個演講大概在34分鐘的地方,簡單易懂,值得看一下。

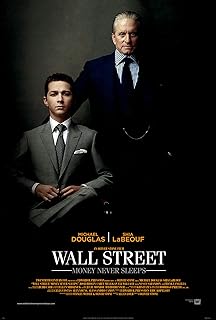

《華爾街:金錢永不眠》

你們都完蛋了。你們還不知道,但是你們處於忍者時代,沒錢要忍耐,沒有工作要忍耐,沒有資產也要忍耐,未來還有很長的路等著你們。

有人提醒我,我曾經說過:「貪心是好事」,現在看來貪心是合法的。

我的酒保因為貪心,買了三間他付不起的房子,沒錢付貸款。你們的父母因為貪心,把房子多貸款五萬塊,把多出來的錢拿去購物中心,買電漿電視、手機、電腦、SUV,那麼既然如此,為何不再買一間房子?因為我們都知道美國的房價只漲不跌,對吧?

貪心讓這個國家的政府,在9/11時間之後,將利率降到百分之一,以促進全民消費。有很多信用公司和機構的名稱誕生了,CMO、CDO、SIV、ABS。世界上真的懂得這些簡稱的人十根手指都能數出來。我來告訴你們這些代表什麼,這些代表了大規模殺傷性武器。

我在監獄的時候,世界上的貪念,加上渴望,像雪球越滾越大。投機性的投資團體每年賺五千萬至一億以上。銀行家看到了,羨慕的說:「我的生活好無聊。」於是他決定用你的錢,把利息提高40%,50% 到 100%。你的錢,不是他的錢,是你的,因為他有權利。是你要去借錢,而他不用。這筆生意的美妙之處在於,沒有人需要負責任,因為大家都相信同一套謊言。

各位,在去年一年,金融服務業的獲利佔全美國公司總共的百分之四十,而非製造業,跟美國大眾的需求一點關係也沒有。事實上,我們都已經深陷其中了,銀行、消費者,我們都盲目地花錢。拿一塊錢,注射很多類固醇,稱之為「槓桿作用」,我叫它「類固醇投資」。

我在金融業還算是個聰明的傢伙,或許是我坐牢坐太久了,但也許監獄是唯一讓人頭腦清醒的地方。從牢房的欄杆往外望,說:「喂!外面的人都腦殼壞掉了嗎?」

聰明人就會清楚明白,投機是萬惡之源,最終的結局,就是以小博大而欠債,無止盡的貸款。我很不願意告訴你們,但這是破產的典範,這是一條不歸路。這是系統性,全球性的惡性循環,就像癌症,它是一種病,而我們需要去抵抗。要如何抵抗?要怎麼是用金錢來對自己有利?我來告訴你,三個字,買我書!

Wall Street: Money Never Sleeps

You are all pretty much fucked. You don』t know it yet, but you are the ninja generation. No income, no job, no assets. You』ve got a lot to look forward to.

Someone reminded me the other evening that I once said 「greed is good」. Now it seems it is legal.

But it is greed that makes my bartender buy three houses, he cannot afford with no money down. And it is greed that makes your parents refinance their $200,000 dollar house for $250,000. Then they take the extra $50,000 go down the mall. They buy a plasma TV, cell phones, computers, a SUV, hey, why not a second home while we are at it. And we all know the prices of houses in America always go up, right?

And it is greed that makes the government of this country cut the interest rates to 1% after 9/11 so we can all go shopping again.

They got all these fancy names for trillions of dollars for credit, CMO, CDO, SIV, ABS. You know I honestly think there are only 75 people in the world who know what they are. But I will tell you what they are. They are WMDs, Weapons of mass destruction.

When I was away, it seemed that greed got greedier with a little bit of envy mixed in.

Hedge fund’s just walking home with $50 to $100 million bucks a year. So Mr. Banker looks around and he says my life looks pretty boring. So he starts to leverage his interest up to 40%, 50% to 100% with your money not his, yours, because he could. You are supposed to be borrowing not them.

And the beauty of the deal is no one is responsible. Because everybody is drinking the same cool-aid.

Last year ladies and gentlemen, 40% of all American corporate profits came from the financial services. Not production, not anything remotely to do with the needs of the American public. The truth is we are all part of it now. Banks, consumers are moving the money around in circles.

We take a buck, we shoot it full of steroids and we call it leverage. I call it steroid banking.

Now I have been considered a pretty smart guy when it comes to finance. Maybe I was in prison too long, but sometimes it is the only place to stay sane, and look out from the bars and say, hey is everyone out there nuts?

It is clear as a bell to those who pay attention. The mother of all evil is speculation. Leverage debts, the bottom line is, it is borrowing to the hilt. And I hate to tell you this, but it is a bankrupt business model. It won』t work. It is systemic, malignant, and it’s global. Like cancer, it is a disease. And we got to fight back. How we going to do that? How we are going to leverage that disease, back in our favor? I will tell you, three words, buy my book!