電影訊息

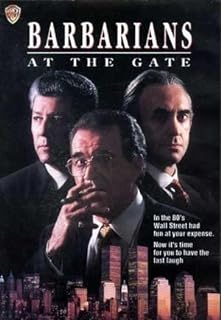

登龍遊術--Barbarians At The Gate

編劇: Bryan Burrough John Helyar

演員: 詹姆斯葛納 強納森普萊斯 彼德瑞森 喬安娜卡西迪

门口的野蛮人/登龙游术/门口的野蛮人

導演: 格蘭喬登編劇: Bryan Burrough John Helyar

演員: 詹姆斯葛納 強納森普萊斯 彼德瑞森 喬安娜卡西迪

電影評論更多影評

2010-04-03 19:22:05

BATG補充閱讀

http://www.investopedia.com/articles/financial-theory/08/leveraged-buyouts.asp

關鍵還是理解LBO,否則這電影對於非管理類的人看,太折磨。

Leveraged buyouts (LBOs) have probably had more bad publicity than good because they make great stories for the press. While the stories surrounding LBOs are exciting, the concept of the process is quite simple and, if used correctly, can lead to a successful future for a company that may be in crisis. Read on to find out how.

Leveraged Buyouts

The media would like the average investor to believe that a buyout, whether leveraged or not, is ruthless in nature, leads to massive restructuring and layoffs, rips off the common man and eventually bankrupts the company as the fat cats get rich. LBOs remind many people of the movie "Barbarians at the Gate" (1993), based (some say loosely) on the true story of when then-CEO Ross Johnson made plans to buy out the rest of the R.J.R. Nabisco company after seeing the results of the failure of Premier,the company's smokeless cigarette. The drama unfolds as Johnson's character initially discusses doing the LBO with Henry Kravis and his company, but attempts to use Shearson Lehman Hutton instead. In this case, a certain level of pride and greed was involved and the drama ended with an inflated buyout price and an incredible debt load. (For more on movies about Wall Street, see Financial Careers According To Hollywood.)

LBO is the generic term for the use of leverage to buy out a company. The buyer can be the current management, the employees or a private equity firm known as outsiders. Some leveraged buyouts occur in companies experiencing hard times and potentially facing bankruptcy, or they may be part of an overall plan. Not all LBOs are regarded as predatory.

Common Buyout Scenarios and Positive and Negative Effects of LBOs

Leveraged buyouts can have positive and negative effects, depending on which side of the deal you are on. There are many scenarios driving a buyout, but four examples are the repackaging plan, the split-up, the portfolio plan and the savior plan.

關鍵還是理解LBO,否則這電影對於非管理類的人看,太折磨。

Leveraged buyouts (LBOs) have probably had more bad publicity than good because they make great stories for the press. While the stories surrounding LBOs are exciting, the concept of the process is quite simple and, if used correctly, can lead to a successful future for a company that may be in crisis. Read on to find out how.

Leveraged Buyouts

The media would like the average investor to believe that a buyout, whether leveraged or not, is ruthless in nature, leads to massive restructuring and layoffs, rips off the common man and eventually bankrupts the company as the fat cats get rich. LBOs remind many people of the movie "Barbarians at the Gate" (1993), based (some say loosely) on the true story of when then-CEO Ross Johnson made plans to buy out the rest of the R.J.R. Nabisco company after seeing the results of the failure of Premier,the company's smokeless cigarette. The drama unfolds as Johnson's character initially discusses doing the LBO with Henry Kravis and his company, but attempts to use Shearson Lehman Hutton instead. In this case, a certain level of pride and greed was involved and the drama ended with an inflated buyout price and an incredible debt load. (For more on movies about Wall Street, see Financial Careers According To Hollywood.)

LBO is the generic term for the use of leverage to buy out a company. The buyer can be the current management, the employees or a private equity firm known as outsiders. Some leveraged buyouts occur in companies experiencing hard times and potentially facing bankruptcy, or they may be part of an overall plan. Not all LBOs are regarded as predatory.

Common Buyout Scenarios and Positive and Negative Effects of LBOs

Leveraged buyouts can have positive and negative effects, depending on which side of the deal you are on. There are many scenarios driving a buyout, but four examples are the repackaging plan, the split-up, the portfolio plan and the savior plan.

評論